It’s not uncommon to start a business while still working a day job. And while it’s helpful to have an outside source of personal income in the beginning it can make for long hours and little if any work-life “balance.”

If you’ve been working full-time and building your business on the side your day might look something like this:

4 AM wake up

5 AM clients or business work

8 AM eat, shower, and head to J.O.B.

9 AM clock in at J.O.B.

5 PM clock out of J.O.B.

6 PM clients or business work

8 PM home, dinner, family

10 PM bed

What’s that? You have clients and business work on weekends too? Of course you do, you’re getting a business off the ground.

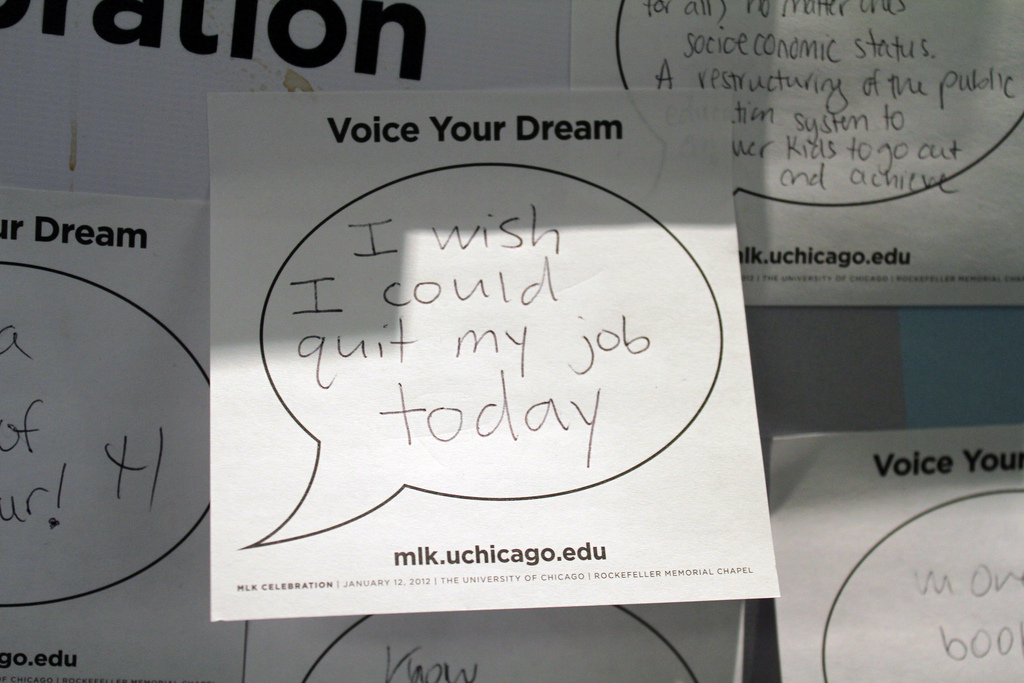

Does this sound like you? Are you ready to quit your day job and focus on your business full-time?

You need a quitting plan — one for getting your business to a spot where you can quit your day job.

If you’re extremely risk tolerant you might jump in with both feet, turn your back to the wind, and say “let’s do this!”

If you’re of the slightly more cautious ilk — you have a spouse, kids, or an African Ringneck parakeet to feed — you’ll want to create a plan to cover the bases and prepare for any contingencies.

Here are six things to do before saying goodbye to your nine to five.

Include significant people in your plans

Are you married? Do you have kids? Transitioning from a consistent, guaranteed paycheck to relying on your business earnings can be stressful––be sure to include your significant other in these discussions from the outset. If you tolerate risk more than your significant other consider building up a bigger cushion in savings to help allay their fears.

Establish traction

How much business do you have? The greater your initial traction, the more confident you can be in your ability to grow when you’re working full-time on your business. If you have little initial traction you’ll want to carefully evaluate your local market to be sure it can support your business. Consider implementing a referral program to encourage your current clients to refer friends and family. The bigger your client base, the better your position on quitting day.

Know the numbers

Use conservative growth estimates and build a projection spreadsheet or pro forma — an estimated financial statement that uses current trend data from your business (new clients per month, average revenue per client, conversion rate, attrition rate, etc.) and provides a picture of how your business will perform in the future if those assumptions hold true. This will help you understand the variables in your business and how they affect your ability to pay yourself what you’re currently earning from your day job. If done properly you should be able to see exactly what you need to do (and approximately how long it will take) to replace your current income with earnings from your business. If you don’t know how to build one of these find someone who can help.

Determine your capital needs

Your pro forma will give you a good idea as to the amount of working capital you’ll need. If your business isn’t yet profitable you’ll need at least enough to cover any operating expenses for the number of months in the red on the pro forma. Depending on your risk tolerance, you may want to add an additional three to six months worth of working capital to that initial figure.

Research, plan, and implement systems

Do you have a marketing plan in place? Are you operating with industry standard tools and software systems? If you spend time planning and creating systems now you’ll be ready to execute on them when you finally quit your day job.

Get frugal

Get up front and personal with your budget. How much are you spending on non-essentials like new clothes, eating out, and your cable bill? Find the gristle and trim it! Set aside these savings for when you quit.

If your business isn’t yet able to completely replace the income from your day job you’ll want to set aside enough money in savings to help offset the reduced income until you’re able to pay yourself what you’re earning currently. Plan to set aside at least six months of living expenses — even longer if you’re more risk-averse.

If making the transition is a top priority, your ability to live as lean as possible for several months can help make your dream a reality.

Take your time and make a plan. The better you prepare before quitting, the more you’ll enjoy the transition. With a plan in place, you’ll have less stress and far fewer grey hairs!

photo credit: Day 339: Only for Now via photopin (license)