Did you know that Account Credit can actually help you save money and have a positive effect on your bottom line? Business Owners are faced with decisions every day and most of these decisions can have a direct impact on your revenue and, in turn, your net profit. Account credit can also be beneficial in several different ways. Here are 5 facts on how account credit can benefit your business.

Keep money in your business

By assigning a monetary credit as opposed to a refund you are guaranteeing that the funds will return to your business and, therefore, contributing to your net income. The funds in question will not be used elsewhere or with another business. Account credit can also help you “retain” customers. Customers know they have an existing account credit and are more likely to come back to redeem it towards goods or services.

Save on merchant processing fees

Your merchant processor will charge an additional fee for a refund transaction, therefore, doubling the number of fees associated with this single transaction, one fee for the original transaction and a 2nd fee for the refund. As you may be aware, the fees can add up quickly. Avoid these unnecessary fees by using Account credit as opposed to refunds.

Control how much account credit can be accrued

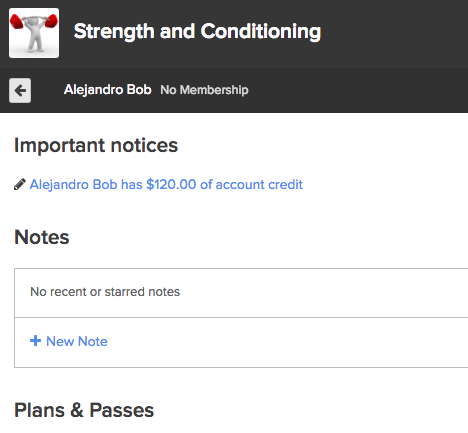

You have the ability to control how much account credit can be accrued by your clients. The advantage of placing ceilings on account credit is that you can avoid being overwhelmed with a large amount of credit that has yet to be accounted for towards a sale. You can pull reports at anytime that can provide you with a total of outstanding account credit.

Account credit can also be used to reward customers

You can offer an account credit for referring another client, for example. It can also be used to help remedy a negative experience. For example, if an instructor cancels last minute you may provide a $5 credit off a future pass purchase which also encourages future sales.

Limit who can apply credit to client accounts

For security reasons, only staff members that have been assigned the role of manager or owner can add credit directly to a client’s account. Staff members and Limited staff members will not be able to provide account credit to individuals thereby guaranteeing that only a few of your staff have this ability.