In Churn Matters Part 1 we talked about finding your churn rate and tracking reasons for churn.

In this post we’ll look at how to evaluate what the right amount of churn is for your business.

It’s probably fairly obvious that the fewer number of cancellations and lower the churn rate in a business the better — but whether a given churn rate is too high really depends on the size of the current membership base, the number of new clients coming in the door each month and how quickly the business wants to grow.

We’ll look at a few examples to evaluate churn threshold — the maximum level of churn that will allow a business to reach its growth goals.

Let’s say we have two businesses that are almost entirely identical — the same number of members, the same number of new trials each month, an identical conversion rate of new trials to member, and identical churn rate of 5%.

Is 5% a decent churn threshold? To answer that we need to know one more thing — we need to know how quickly the business is wanting to grow. Keep in mind that each business may have different expense scenarios that require different growth rates to break even or reach net profit targets. In a more comprehensive analysis the desired growth rate will take into account the expense side of things.

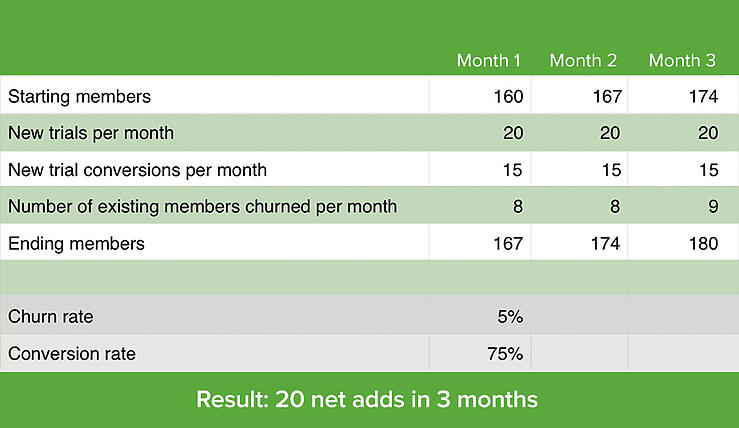

In our example let’s say that Business A and Business B both have the following numbers:

- 160 starting members

- Average of 20 new trials each month

- Conversion rate of new trials to member of 75%

- Churn rate of 5%

But — they have different goals for growth:

Business A

Wants to grow to 200 members in the next 3 months (40 net membership additions)

Business B

Wants to maintain a membership base between 150 and 175 (no more than 15 net membership additions)

As you can see with the above metrics both businesses will reach 180 members (20 net adds) after three months.

Business A has not met its goal (20 shy). Business B has grown beyond its target membership base and could therefore tolerate a bit more churn.

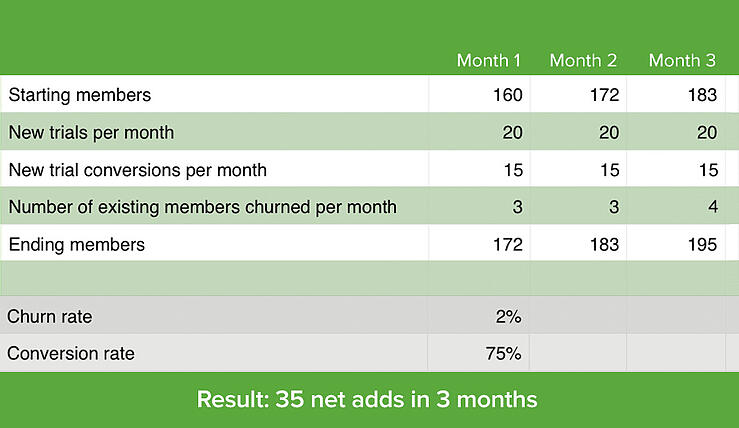

What does it look like if Business A is able to decrease churn to 2%?

Even with a churn rate of 2% Business A is going to fall short. In addition to reducing churn, this business will need to either increase the number of new trials or increase the conversion rate (or a combination of both) in order to hit the 200 membership target in 3 months.

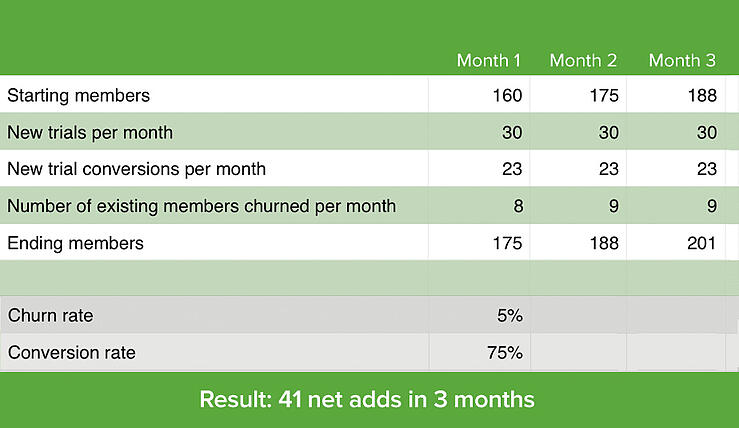

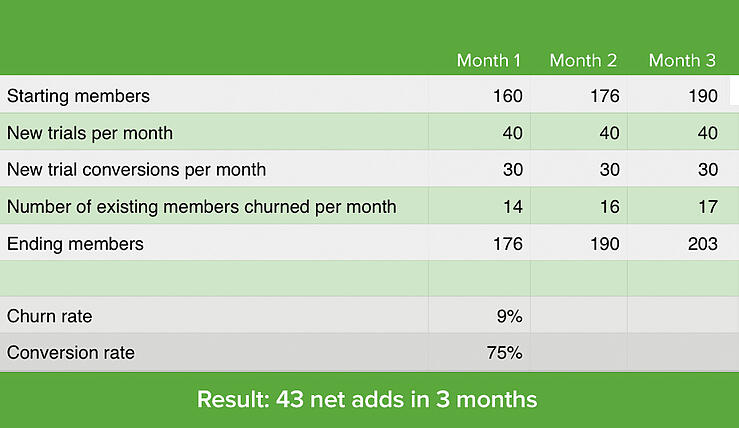

Now let’s assume that both Business A and Business B have the same goal — they both want to reach 200 members within three months. But, this time their numbers differ slightly.

Business A still has a churn rate of 5%, but has 30 new trials per month.

Business B has a churn rate of 9%, but has 40 new trials per month.

Starting members and conversion rate remain the same as previous examples.

Business A

Business B

As you can see, both businesses reach their target of 200 memberships. Business B can tolerate a slightly higher churn rate and still grow quickly due to the significantly higher number of new trials each month.

To sum it up:

The amount of churn your business can tolerate is highly dependent on the number of new client trials you see each month and your ability to convert those clients to members. If you have no shortage of new clients, and a reasonable conversion rate, you can likely tolerate a greater churn rate (dependent of course on how quickly you’re looking to grow).

However, if new client numbers are low, your conversion rate isn’t great and you have aggressive growth goals you cannot tolerate much churn at all.

In Part 3 of this series we’ll look at some ways to minimize churn. Stay tuned!